Clark Wealth Partners - The Facts

The Single Strategy To Use For Clark Wealth Partners

Table of ContentsThe Clark Wealth Partners IdeasThe Best Strategy To Use For Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedThe Best Guide To Clark Wealth PartnersWhat Does Clark Wealth Partners Mean?Get This Report about Clark Wealth PartnersThe 6-Minute Rule for Clark Wealth Partners

The globe of financing is a complicated one. The FINRA Structure's National Capacity Research Study, for instance, lately located that almost two-thirds of Americans were unable to pass a basic, five-question economic proficiency examination that quizzed individuals on topics such as passion, financial obligation, and various other relatively standard principles. It's little wonder, then, that we typically see headlines regreting the bad state of the majority of Americans' financial resources (financial planner scott afb il).Along with managing their existing customers, financial experts will certainly commonly invest a fair amount of time every week conference with prospective customers and marketing their solutions to keep and grow their company. For those considering coming to be an economic advisor, it is important to think about the average salary and work stability for those operating in the area.

Training courses in tax obligations, estate planning, financial investments, and danger management can be handy for students on this course. Depending upon your one-of-a-kind job objectives, you might likewise require to gain specific licenses to fulfill specific customers' needs, such as dealing stocks, bonds, and insurance coverage. It can likewise be valuable to earn a qualification such as a Certified Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Personal Financial Expert (PFS).

The Main Principles Of Clark Wealth Partners

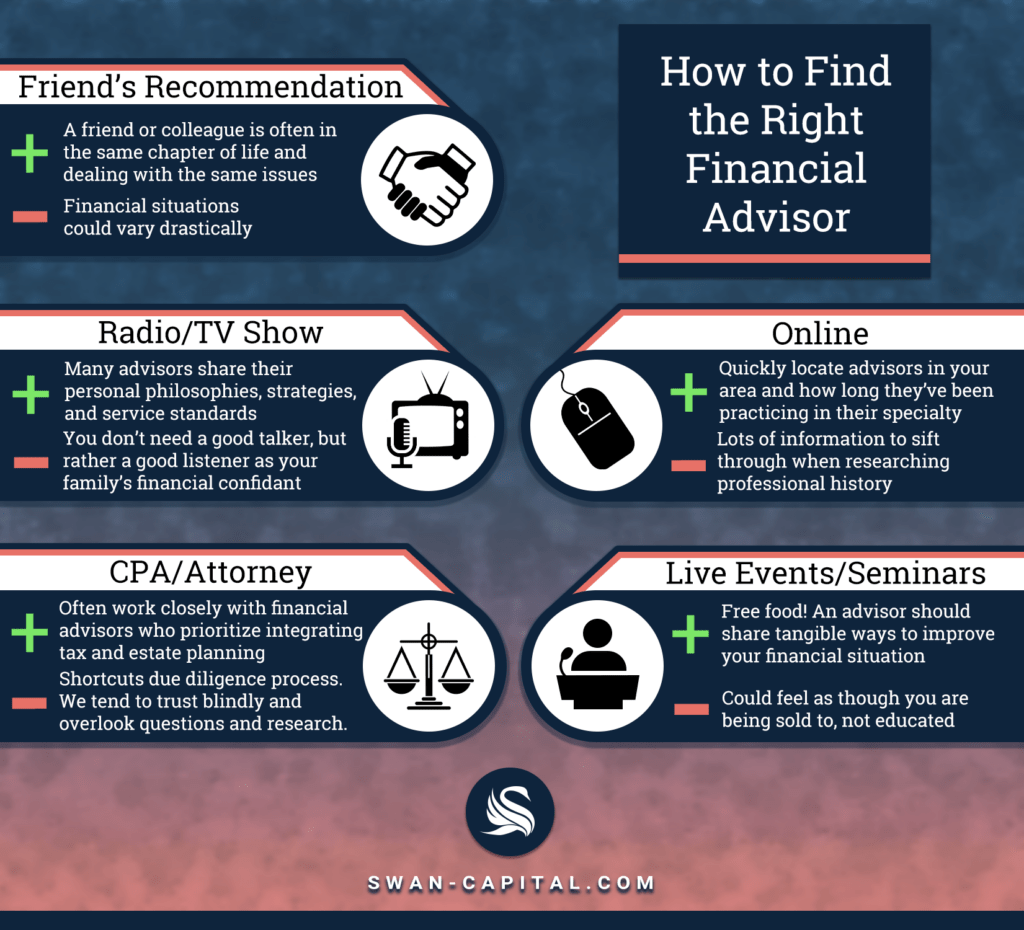

Several individuals choose to get assistance by utilizing the services of a financial professional. What that looks like can be a number of points, and can vary depending upon your age and phase of life. Before you do anything, research study is vital. Some individuals fret that they need a certain quantity of money to spend prior to they can obtain help from a specialist.

The Best Guide To Clark Wealth Partners

If you have not had any kind of experience with a monetary consultant, here's what to anticipate: They'll begin by providing a detailed assessment of where you stand with your assets, obligations and whether you're satisfying criteria contrasted to your peers for cost savings and retired life. They'll assess brief- and lasting goals. What's helpful about this step is that it is individualized for you.

You're young and working complete time, have an automobile or 2 and there are trainee financings to settle. Right here are some possible concepts to aid: Develop great cost savings practices, repay financial obligation, established standard objectives. Settle student car loans. Depending published here upon your occupation, you may qualify to have component of your college funding forgoed.

Not known Facts About Clark Wealth Partners

You can go over the next ideal time for follow-up. Financial experts generally have various rates of pricing.

You're looking ahead to your retired life and helping your youngsters with greater education prices. A financial advisor can use suggestions for those situations and even more.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Arrange routine check-ins with your coordinator to tweak your plan as required. Stabilizing savings for retirement and university costs for your kids can be tricky.

Thinking of when you can retire and what post-retirement years might appear like can create issues regarding whether your retired life financial savings are in line with your post-work plans, or if you have conserved sufficient to leave a heritage. Help your economic expert recognize your technique to money. If you are much more conventional with conserving (and prospective loss), their ideas ought to reply to your fears and problems.

The 45-Second Trick For Clark Wealth Partners

Preparing for wellness care is one of the large unknowns in retirement, and a monetary expert can detail choices and suggest whether extra insurance policy as protection may be handy. Prior to you begin, try to obtain comfortable with the idea of sharing your entire monetary photo with an expert.

Offering your specialist a full picture can aid them produce a strategy that's focused on to all components of your financial status, particularly as you're fast approaching your post-work years. If your finances are easy and you have a love for doing it on your own, you might be great on your own.

An economic consultant is not only for the super-rich; anybody facing significant life shifts, nearing retirement, or feeling overwhelmed by economic choices could take advantage of professional support. This post explores the function of monetary experts, when you may require to seek advice from one, and vital factors to consider for picking - https://myanimelist.net/profile/clrkwlthprtnr. A financial consultant is a skilled expert that helps customers handle their financial resources and make notified decisions that align with their life objectives

The Basic Principles Of Clark Wealth Partners

Settlement designs also differ. Fee-only advisors bill a flat charge, per hour price, or a percent of possessions under monitoring, which tends to decrease potential disputes of interest. On the other hand, commission-based consultants gain revenue via the financial products they market, which may affect their recommendations. Whether it is marital relationship, separation, the birth of a child, profession modifications, or the loss of a loved one, these events have special economic ramifications, usually needing timely decisions that can have lasting effects.