Some Known Details About Clark Wealth Partners

The Greatest Guide To Clark Wealth Partners

Table of ContentsExamine This Report on Clark Wealth PartnersThe 5-Minute Rule for Clark Wealth PartnersIndicators on Clark Wealth Partners You Need To KnowClark Wealth Partners Things To Know Before You BuyGetting My Clark Wealth Partners To Work

Their duty is to aid you make educated choices, stay clear of pricey blunders, and remain on track to meet your long-term purposes. Managing finances can be daunting, and feelings frequently cloud judgment when it involves money. Worry and greed, for instance, can bring about impulsive choices, like panic-selling throughout a market recession or going after options that don't line up with your danger resistance.

It's crucial to recognize their charge framework and guarantee it fits your monetary scenario. For numerous people, the experience, objectivity, and satisfaction that an advisor gives can be advantageous, however it is essential to think about the connected expenses. Simply as athletes, trainers, and trainers aid people achieve their ideal in other locations of life, a monetary advisor can play a critical role in aiding you develop and secure your economic future.

Investors should make financial investment choices based on their unique financial investment goals and economic scenario (https://www.webmastersun.com/members/clarkwealthpt.146872/#about). ID: 00160363

A Biased View of Clark Wealth Partners

It's concerning helping clients to browse adjustments in the environment and recognize the effect of those adjustments on a recurring basis," states Liston. An advisor can additionally assist clients manage their possessions a lot more successfully, states Ryan Nobbs, a monetary advisor for M&G Wealth Guidance. "Whereas a client may have been saving formerly, they're now mosting likely to start to attract an income from various possessions, so it's about placing them in the ideal products whether it's a pension, an ISA, a bond and afterwards drawing the revenue at the correct time and, critically, keeping it within certain allocations," he states

Retired life preparation is not a one-off occasion, either. With the popularity of revenue drawdown, "financial investment does not quit at retired life, so you need an aspect of experience to understand exactly how to get the appropriate blend and the appropriate balance in your financial investment options," claims Liston.

More About Clark Wealth Partners

As an example, Nobbs had the ability to assist among his customers relocate cash into a variety of tax-efficient items so that she might draw an income and wouldn't have to pay any type of tax till she had to do with 88. "They live conveniently now and her hubby was able to take very early retirement consequently," he claims.

"People can end up being actually worried concerning just how they will certainly money their retired life since they do not understand what placement they'll remain in, so it pays to have a discussion with a monetary advisor," says Nobbs. While saving is one noticeable advantage, the worth of guidance runs much deeper. "It's everything about offering individuals peace of mind, recognizing their demands and aiding them live the lifestyle and the retired life they desire and to take care of their household if anything should take place," says Liston.

Seeking financial suggestions may appear overwhelming. It's commonly not an inquiry of affordability but of trust. In the UK, that is fuelling an expanding guidance space only 11% of adults checked claimed they 'd paid for monetary advice in the previous 2 years, according to Lang Pet cat research. That is why it is so crucial to choose an adviser with a solid track document.

This is recognized as a restricted advice solution. With adjustments in tax obligation regulation and pension plan guideline, and ideally a lengthy retirement in advance, individuals approaching the end of their jobs need to navigate a significantly tough background to ensure their financial requirements will certainly be satisfied when they retire.

5 Easy Facts About Clark Wealth Partners Shown

"If you get it wrong, you can end up in a collection of complicated scenarios where you could not have the ability to do the things you intend to carry out in retirement," says Ross Liston, CEO of M&G Riches Guidance. Looking for financial recommendations is an excellent idea, as it can aid individuals to enjoy a stress-free retirement.

While there's a riches of economic preparation info available, it's significantly challenging to progress with a determined method that doesn't panic or stay asleep at the wheel. A monetary strategy customized to your particular circumstance creates purposeful worth and assurance. And while it may be alluring to self-manage or utilize a robo-advisor to conserve on specialist costs, this approach can prove expensive in the future.

Right here are the leading 5 reasons hiring a specialist for financial advice is beneficial. While it may be alluring to self-manage or utilize a robo-advisor to minimize specialist costs, this approach can verify pricey in the long run. An economic advisor that gives an independent and objective viewpoint is crucial.

What Does Clark Wealth Partners Do?

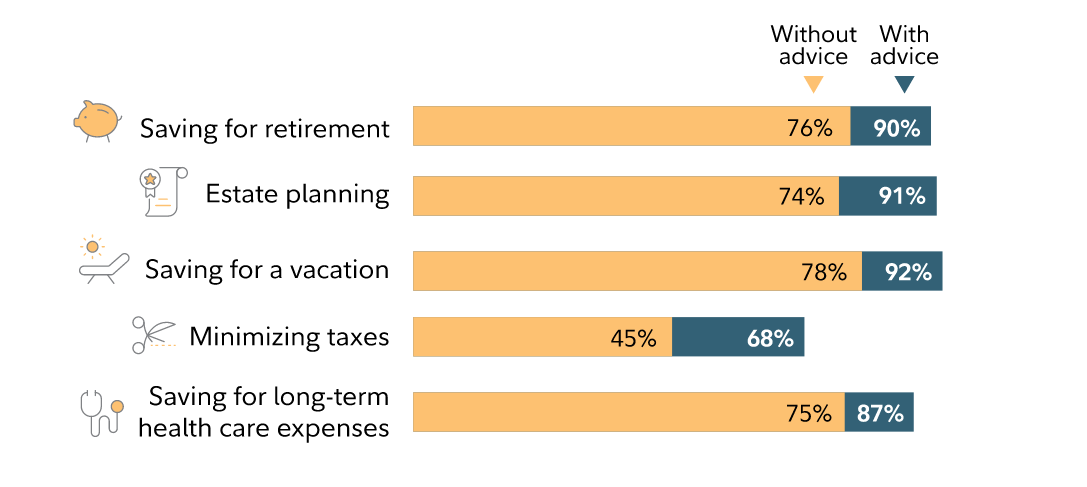

By contrast, investors that are functioning have a tendency to value retirement and tax preparation guidance most extremely. These searchings for might display some generational effect, considering that monetary advice traditionally has been even more concentrated on financial investments than financial preparation (financial company st louis). The intricacy of one's scenarios also might have an impact on the understanding of value

All told, individuals that spend for suggestions ranked a lot more recommendations aspects as really beneficial than those that did not. This result might suggest that finding worth in even more elements causes people to spend for guidance. Nonetheless, the opposite might be real in many cases: Paying for an expert may enhance the belief that the advantages are beneficial.

Considering that the economy modifications and progresses each day, having a rational friend on your side can be a definitive variable for effective investment decisions. Every individual has his or her own financial scenario and challenges to handle (http://www.gobarstow.com/services/clark-wealth-partners). A monetary organizer thoroughly checks your present assets and obligations, and future goals to establish an individualised individual financial strategy